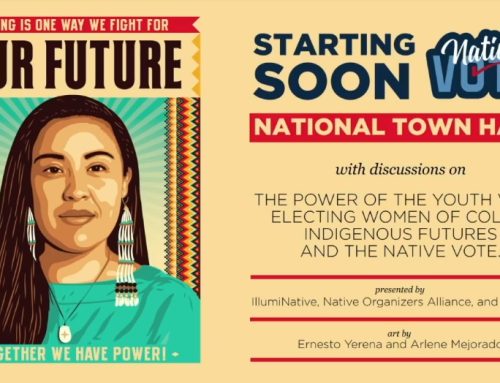

On Monday, July 22nd, 2013, the California Valley Miwok Tribe decided to post this public service announcement (received from the USA.gov Team) because this involves subject matter that the Tribe knows all too well.

For more info call: 1-800-FED-INFO (333-4636).

Identity thieves steal your personal information to commit fraud. They can damage your credit status and make it difficult to restore your good name. Tips for preventing identity loss: Don’t carry your social security card, protect your PIN, watch out for “shoulder surfers” when using an ATMs; collect mail promptly; pay attention to your billing cycles; keep your receipts and watch for unauthorized transactions; tear up and shred unwanted receipts; store information in a safe place at home and at work; don’t respond to unsolicited requests for personal information in the mail, over the phone or online; install firewalls and virus-detection software on your home computer; check your credit report once a year.

Free credit reports: You can request a free credit report once a year from each of the three major credit reporting agencies – Equifax, Exporian, and TransUnion. You may want to request your credit reports one at a time, every four months, so you can monitor your credit throughout the year without having to pay for the report. (If you ask the credit bureaus directly, they will charge you a fee to obtain your report.) To order your free report, you must go through https://www.annualcreditreport.com or call 1-877-322-8228.

Medical Identity Theft: Medical identity theft can occur when someone steals your personal information number to obtain medical care, buy medications, or submit fake claims to your insurer or Medicare in your name. If you believe you have been a victim of medical identity theft, file a complaint with the FTC at 1-877-438-4338 or https://reportfraud.ftc.gov/.

For more information about Medicare fraud, visit: https://stopmedicarefraud.org/

Beware Investment Fraud: Deceptive pitches for investment often misrepresent or leave out facts to promote fantastic profits with little risk. No investment is risk-free, and a high rate of return greater risk. Beware if a salesperson pressures you to invest immediately, promises quick profits, or uses words such as “guarantee,” “high return, “or “limited offer.”

Protecting Your Privacy: Identity thieves steal your personal information to commit fraud. They can damage your credit status and cost you time and money to restore your good name.

Reporting Identity Theft: If your identity has been stolen, you can use an ID Theft Affidavit to report the theft to most of the parties involved. All three credit bureaus and many major creditors accept the affidavit. Request a copy of the document by calling toll-free 1-877-438-4338 or visit https://www.ftc.gov/idtheft/.

National Do Not Call Registry: The federal government’s Do Not Call Registry allows you to restrict telemarketing call permanently by registering your phone number at https://www.donotcall.gov or by calling 1-888-382-1222.

Credit Checks – A New Part of the Hiring Process: If you are in the market for a new job, remember that potential employees are reviewing your credit history – For more information about what to know when looking for a job, visit:

https://www.consumer.ftc.gov/articles/0269-what-know-when-you-look-job

Single copies of the current Consumer Action Handbook are available by writing: Handbook, Federal Citizen Information Center, Pueblo, Colorado 81009. The Handbook can also be viewed and ordered online at https://www.usa.gov/consumer-action-handbook/order-form.shtml.